Welcome to InhaleRx Ltd

InhaleRx Ltd (IRX) is an Australian biotechnology company specialising in precision medicine delivered through inhalation.

InhaleRx is actively pursuing New Drug Approvals (NDAs) with the U.S. Food and Drug Administration (FDA) in both Pain and Mental Health Management.

Indications selected have been carefully considered, given there is both a clinical gap and a significant commercial opportunity.

Why Inhaled therapies?

There are many treatment options available to patients that suffer from chronic conditions, but there’s very few safe and effective rapid onset treatment options.

These medications can be used as an adjunct to chronic therapies, or in some cases may replace the need for use of medications to manage symptoms.

- Application of treatment and Mechanism of Action

- Inhaled

- Oral

- Transdermal

- Injectable

- Onset of Action^

- Fast

- Slow

- Slow

- Fast

- Offset of Action^

- Fast

- Slow

- Slow

- Fast

- Bioavailability

- Fast

- Low

- Low

- High

- Not impacted by 1st pass metabolism

- Ease of patient use

- Suitable for Acute Indications

Magnitude of Opportunity

Pain Management Market

The pain management market is estimated to be worth $75 billion (USD) in 2023.

$75

Billion (USD)

IN 2023

- Inhaled analgesic therapies outside of a clinical setting are uncommon.

- Nasal formulations of fentanyl (e.g. Lazanda) have shown to be efficacious, however these were withdrawn due to safety concerns.

- Sublingual fentanyl products (e.g. Actiq, and Fentora) remain as the main treatment options for intense breakthrough pain. Abstral has also been withdrawn in the US.

Clinical Assets Under Development – IRX-211

Breakthrough Cancer Pain Solution

IRX-211 aims to revolutionise the management of Breakthrough Cancer Pain (BTcP) with a non-opioid, rapid-onset inhaled therapy.

Proven Safety

Phase I clinical trials for IRX-211 have been completed with no significant adverse events, showcasing strong safety data.

Regulatory Pathway Defined

The FDA has provided supportive feedback positioning IRX-211 for expedited regulatory approval and commercialisation.

Massive Market Potential

With a $9 billion addressable market in cancer pain by 2028, IRX-211 targets a significant unmet need in pain management.

Global Accessibility

FDA approval paves the way for subsequent approvals in Europe (EMA) and Australia (TGA), enabling broad patient access.

Scalable Demand

Addressing the needs of 1.8 million cancer patients in the U.S. alone, IRX-211 meets the growing demand for effective, non-opioid therapeutic options.

Magnitude of Opportunity

Mental Health

The global anxiety disorder treatment market is projected to reach USD 9 billion by 2030. during the forecast period 2022-2030. It includes panic disorders, post-traumatic stress disorder (PTSD), phobias, and obsessive-compulsive disorder.

- Panic Disorder is estimated to affect approximately 3-5% of the general population.

- More prevalent in women and typically begins in young adulthood. The exact prevalence of panic disorder is difficult to determine, as it is often under-diagnosed and under-treated.

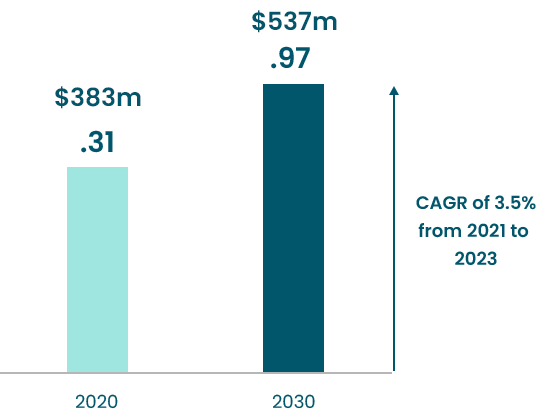

GLOBAL ANXIETY DISORDER TREATMENT MARKET

$9

Billion (USD)

Assets under development – IRX-616a

Innovative Panic Disorder Therapy

IRX-616a is positioned to be the first FDA-approved inhaled medication for Panic Disorder, offering a novel treatment avenue.

Addressing an Urgent Need

With the COVID-19 pandemic increasing the prevalence of anxiety disorders by 25%, IRX-616a addresses a growing health crisis.

Unmet Market Demand

Existing treatments like SSRIs are plagued by side effects, such as disrupted sleep and increased suicidality risks, highlighting the need for alternatives like IRX-616a.

Unique Market Advantage

The lack of competition in inhaled medications for Panic Disorder strengthens IRX-616a’s commercial prospects.

Large Market Opportunity

The total addressable market for anxiety and depression treatments is projected to reach $13.3 billion by 2027.

Strategic Regulatory Plan

An IND has been submitted, and FDA approval would lead to further approvals by the EMA and TGA, enhancing its global reach.

Regulatory Strategy

Faster approval process

Enabling access to use data from previously conducted studies of approved drugs can result in a faster approval process as the FDA.

Cost savings

There are often significant cost-saving opportunities as companies can leverage previously conducted studies of approved drugs, which can reduce the costs associated without executing a full drug-development program.

Reduced regulatory burden

The FDA may not require a full complement of preclinical and clinical studies.

Increased flexibility

The 505(b)(2) pathway provides opportunities to incrementally innovate on already approved drugs.

See Who Are In Team

Management Team

Darryl Davies

Chief Executive Director

Dr. Rob Jenny

Chief Scientific Officer

Dr. Sud Agarwal

Medical Science Consultant

Greg Hammond

Chief Financial Officer

James Barrie

Company Secretary

Board of Directors

Sean Williams

Non-Executive Chairman

Dr Ron Wise

Non Executive Director

Tony Fitzgerald

Non Executive Director

Scientific Advisory Board

Dr Meera Agar

Key Opinion Leader

Dr Megan Ritchie

Clinical Advisor